-

Allianz General remains the No.1 choice in Malaysia

Posted on April 18, 2018 by admin in General NewsThe general insurance market in Malaysia is competitive with 21 general insurance companies fighting for a RM17.65 billion market. The two largest classes of insurance is the Motor and Fire sector, each taking a market share of 47.1% and 19.3% respectively. The Motor premiums in 2017 is RM8.32 billion despite the slight drop in total number of vehicle sold at about 580,000 units. Premium for fire insurance is RM3.41 billion with a modest growth of 4.2%.

2017 is a challenging year as Bank Negera Malaysia implemented the Phased Liberalisation of the Motor Tariff on 1st July 2017. Detariffication of Motor insurance allows insurance companies to set their pricing based on customer profiling, it also allow insurance companies to introduce new & innovative products & services to the public.

Allianz General Insurance was among the first to reduce their pricing for Add-on coverage for Special Perils. From the standard tariff of 0.5% to 0.25%. This effective encourage more people to take up this Special Perils add-on, taking into consideration of the many unexpected flash flood and storm in Malaysia.

It is not surprising that Allianz remains the No.1 of choice among Malaysian. Allianz focuses on customer satisfaction and are always looking at innovative ways to help out its customers. Allianz Road Ranger is one of the most comprehensive customer focus project, whereby Allianz aims to be the first to reach you when you call for assistance. Allianz Bike Ranger will get to you as soon as they receive your distress call.

Allianz Bike Ranger will accompany you and assist you till Allianz Tow Truck arrived to take care of your vehicle. You will be hand-hold steps by steps. Allianz Claims Concierge will be based in major police stations to accompany customers in lodging the police report and explaining the claims process in detail. You will never be let alone with Allianz.

Detariffication allows insurance companies to adjust their pricing, thus, many insurance companies opt to reduce their pricing in return for a share of the market. Although such practice is short-sighted as Motor Sector is a very risky business. Allianz motor insurance premium actually on a higher side, but customer understand that the high premium comes with better for value services.

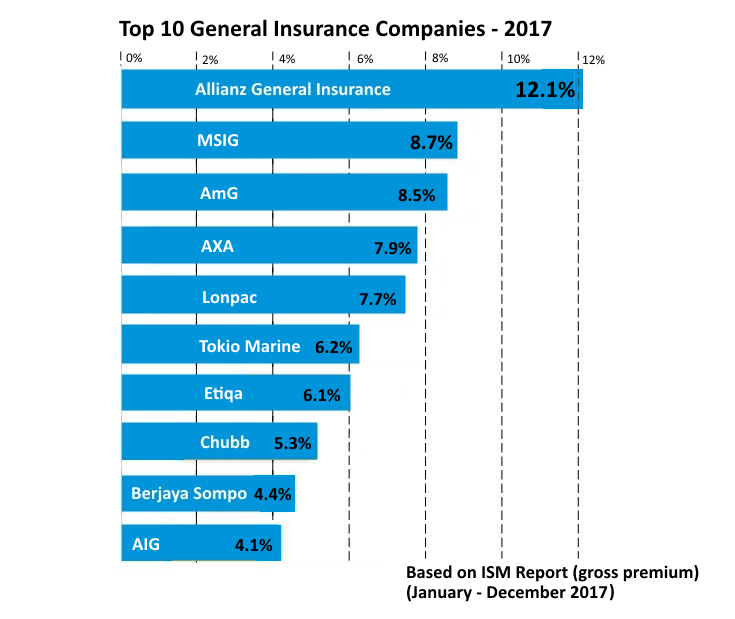

Despite tense competitions, Allianz remains the No.1 market leader with a bigger market share of 12.1%. The Top 10 insurers take up close to 71% of the total market shares. With the remaining 20% shared among the remaining 11 insurers.